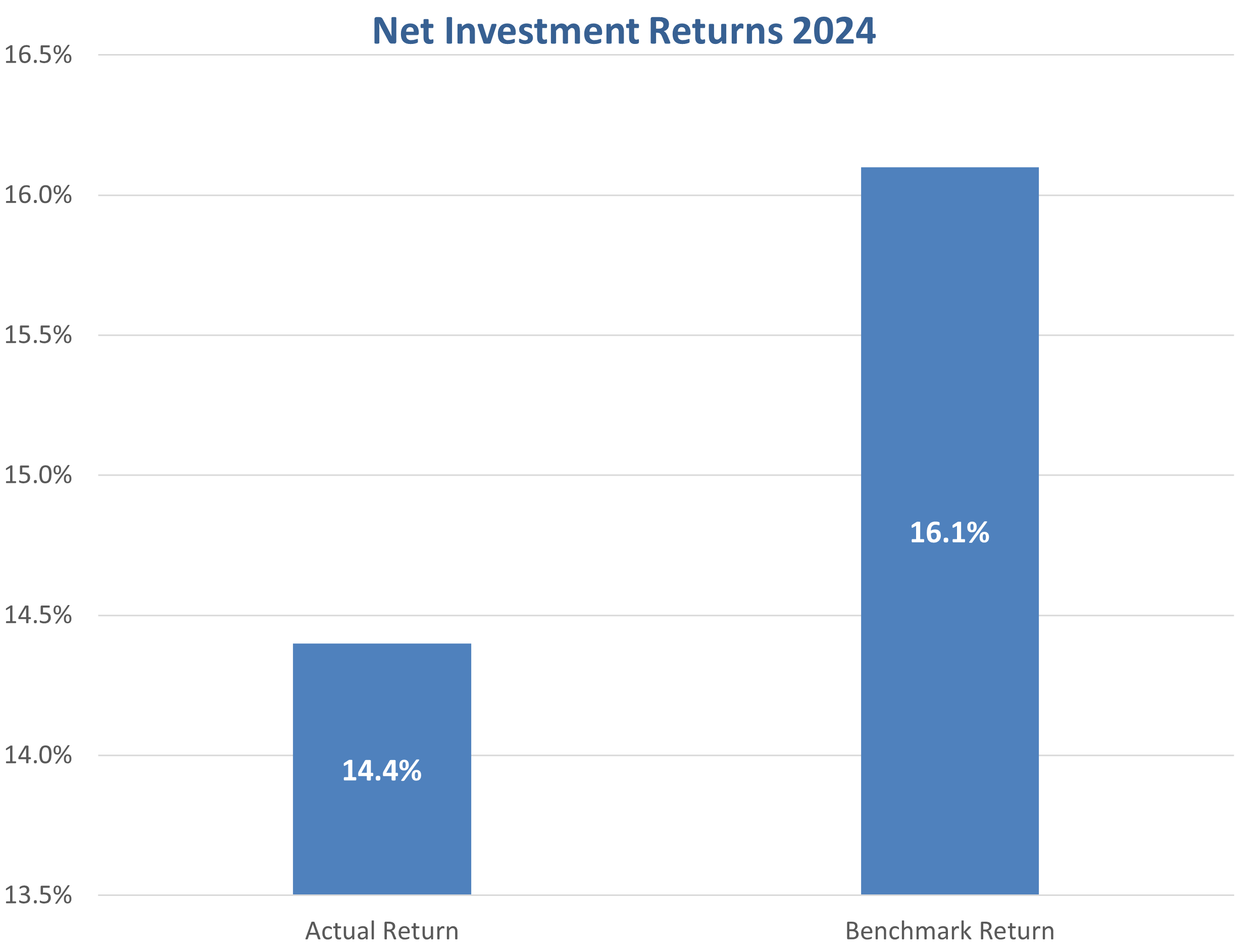

Net Investment Return - 2024

2024 was a year with exceptional performance in public markets and more muted performance in private markets. While we generated our strongest absolute performance on record, benchmark dynamics in private markets led us to underperform our internal benchmark by 1.69%.

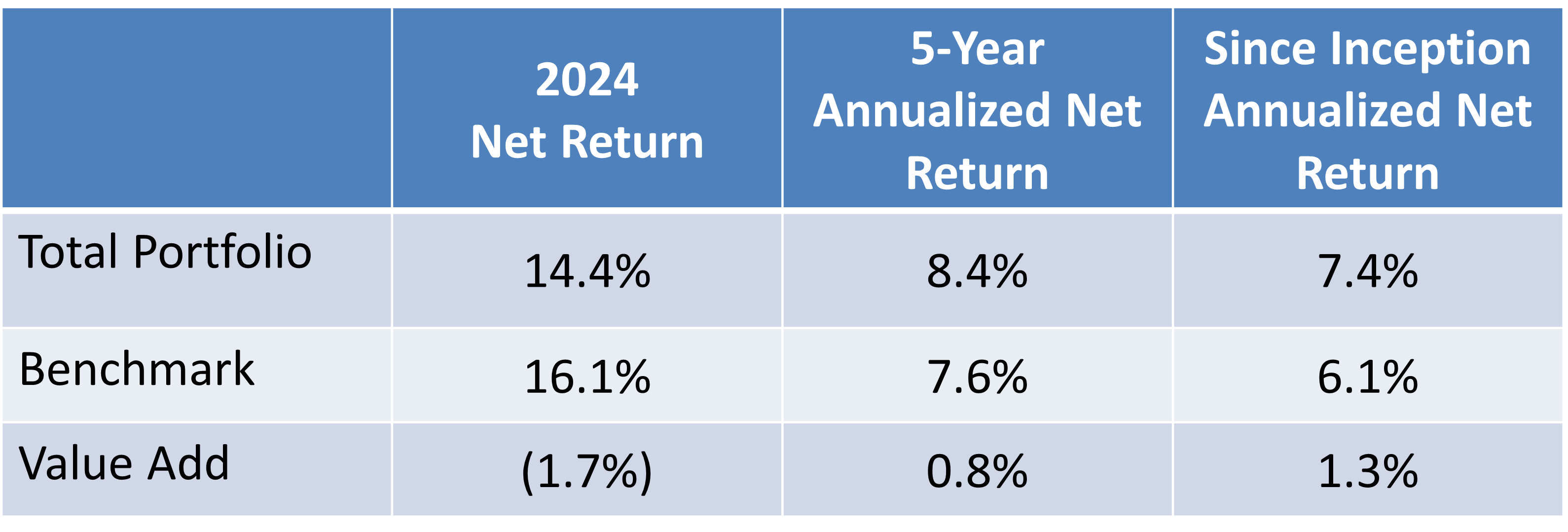

Long-Term Performance

Since pension plans invest for the long-term, it is important to consider our asset performance over an extended period of time. Over the last 25 years, our Plan’s assets have generated a since inception net rate of return to 7.4%, benchmark to 6.1% and outperformance to 1.3%. This represents the value-add from our bias towards active investment.

Breaking our returns down into the various sub-portfolios allows us to determine which asset classes are performing well relative to our expectations. Although it may seem appealing to invest a large portion of a portfolio in a single asset class based on historical performance, it is important to note that doing so can add undue risk and compromise long-term sustainability.

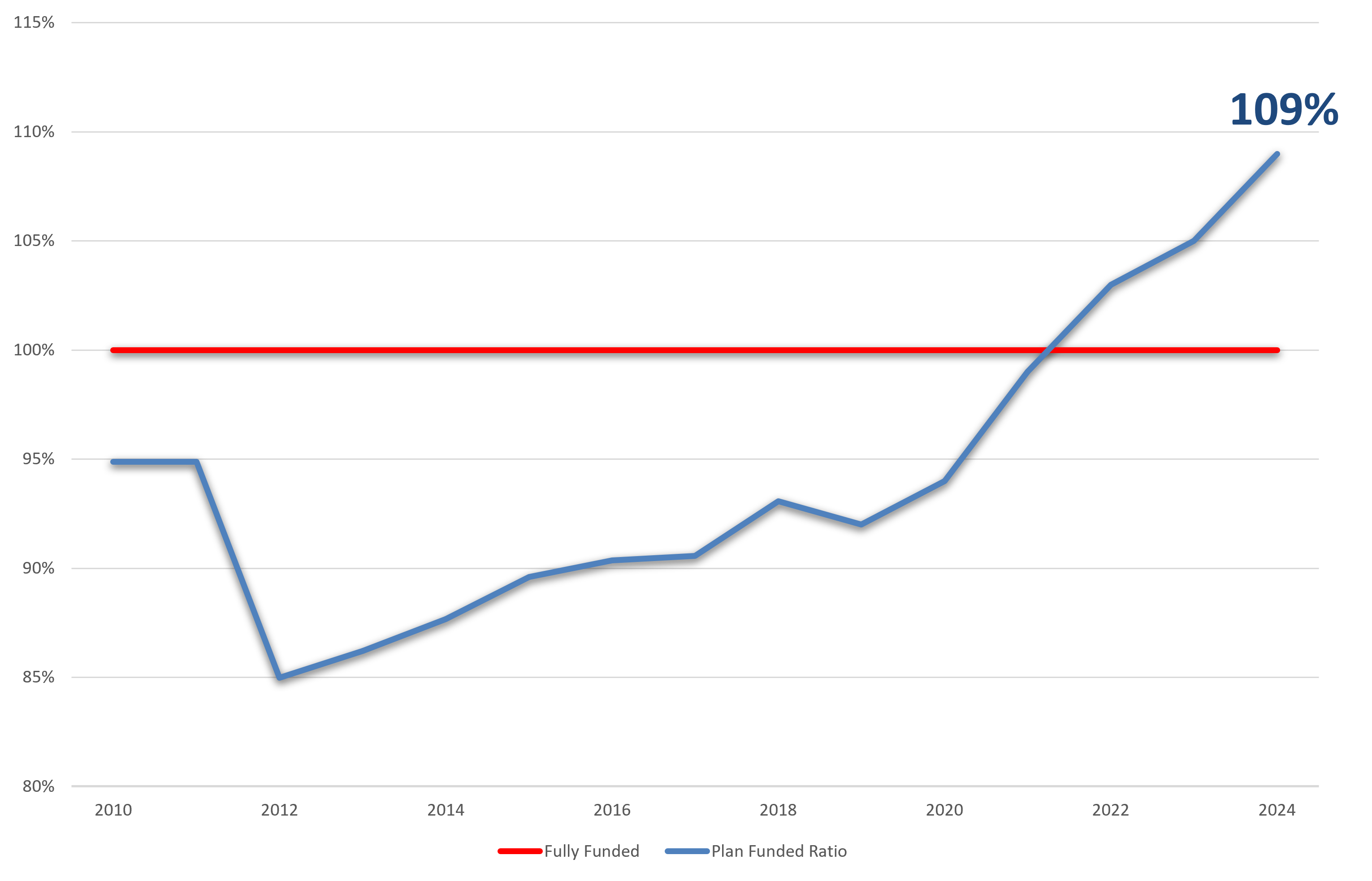

Going Concern Funded Ratio

The Plan is currently estimated to be 109% funded. The Plan's funded ratio is a measure of its financial health and is a key driver of the level of contributions that are required to go into the Plan. It is determined by dividing the Plan's assets by its liabilities. Special contributions, over and above the cost of annual benefit accruals, are being made to bring the Plan to a more sustainable position.