Our Assets

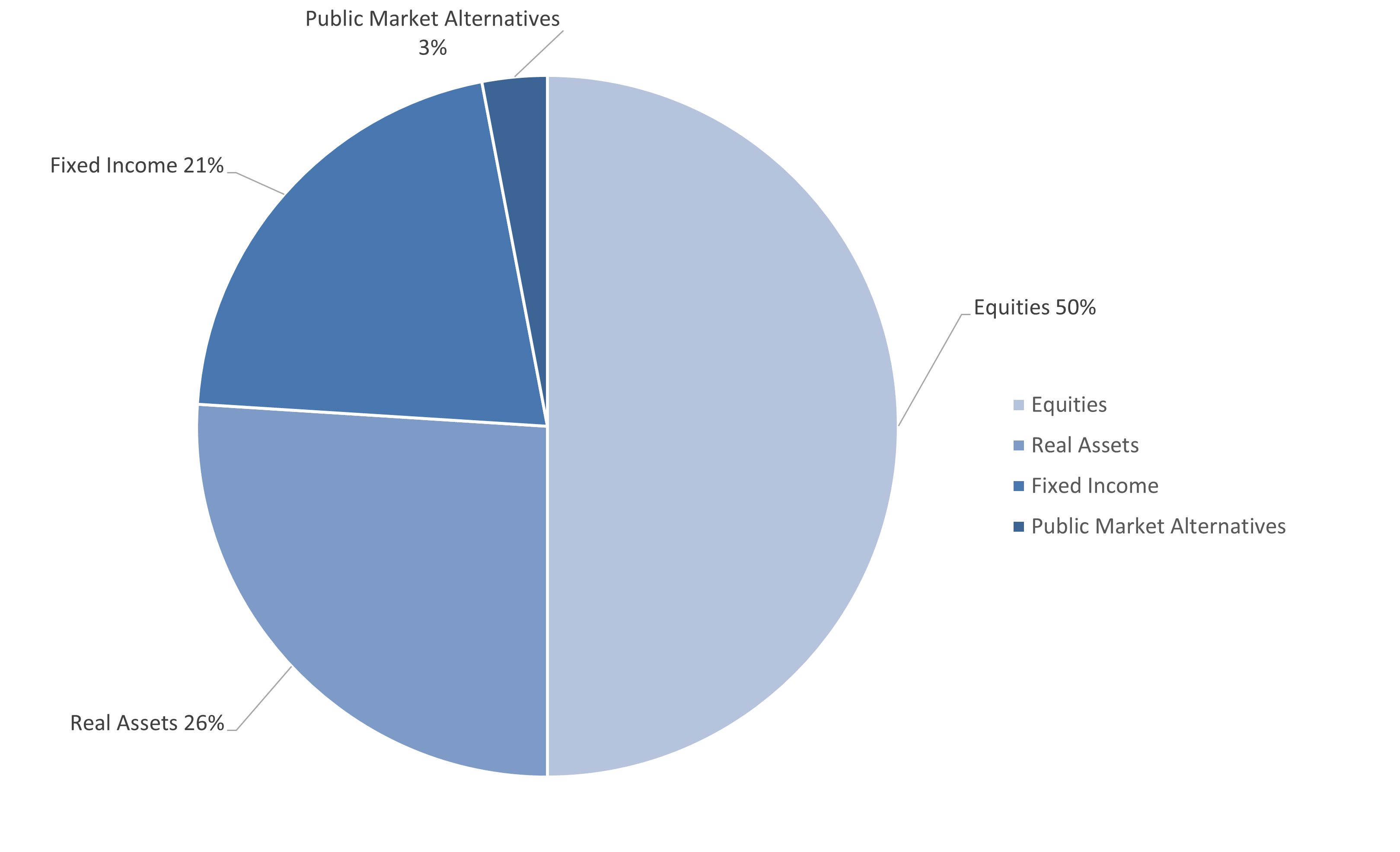

We design our asset mix to provide stability and growth to the Plan’s asset base. We aim to balance the need to generate returns on our capital versus the risks we take. Our diversified portfolio benefits from our participation in a wide range of public and private market investments. We continue to search for these opportunities as we strive to achieve returns that exceed our benchmark and long-term return objective.

The Plan’s policy mix is the long-term asset mix target for the Plan. Deviations from the policy mix are permitted in order to participate in attractive investment opportunities. We monitor these deviations on an ongoing basis and rebalance the portfolio towards the policy mix when deemed necessary.

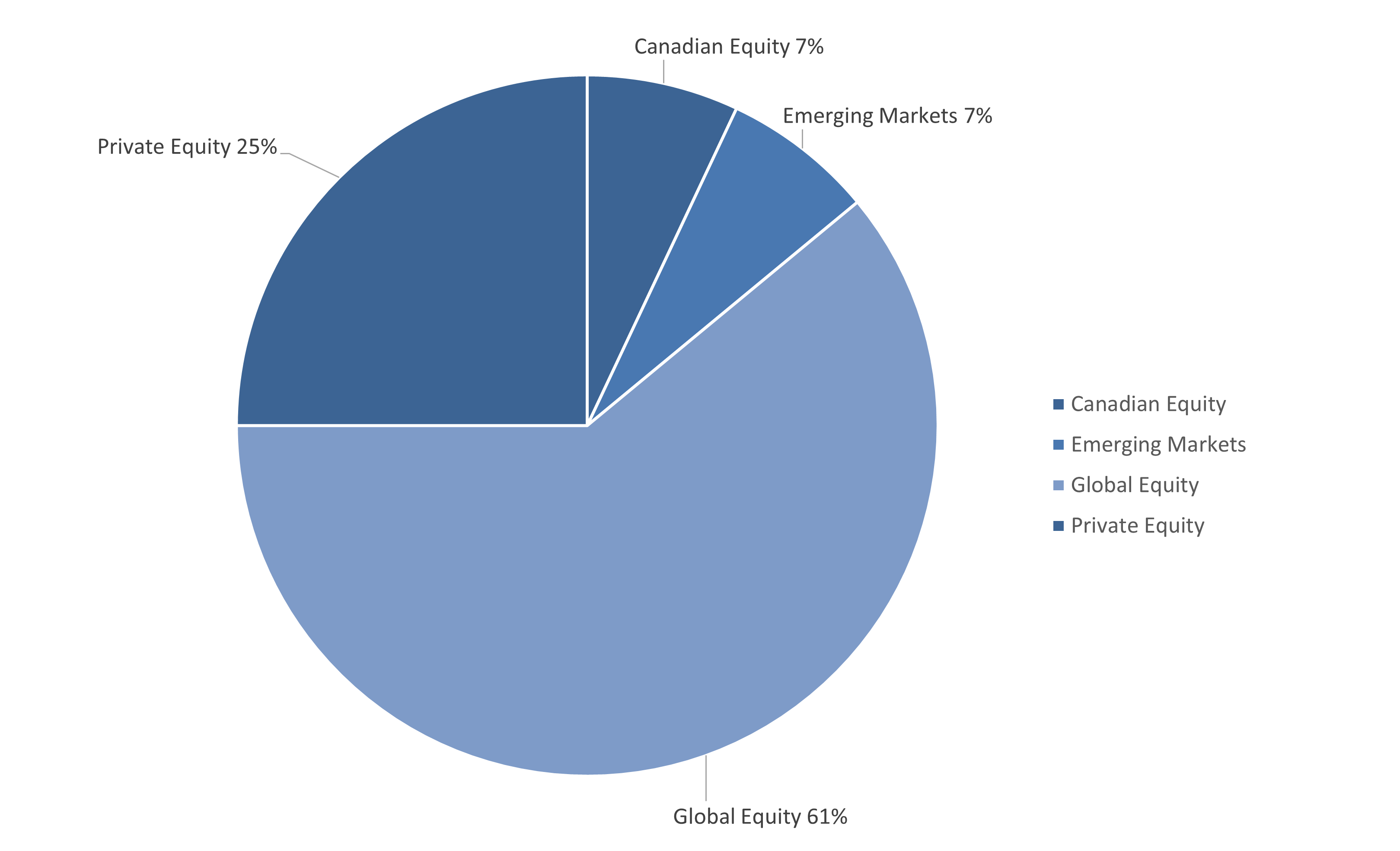

Equities

The Plan’s equities portfolio consists of both public and private equity, represents approximately 50% of the Fund’s total assets.

Public equity represents ownership in public companies. Often referred to as 'stocks', these investments have higher expected rates of return relative to fixed-income securities but generally have a higher degree of risk. They are an important part of our Plan’s asset mix that provide diversification and add to the Plan’s expected rate of return.

Private equity represents ownership stakes in privately owned and managed corporations. We invest in private equity due to the diversification benefit it provides over public equities as well as its higher expected return over the longer-term.

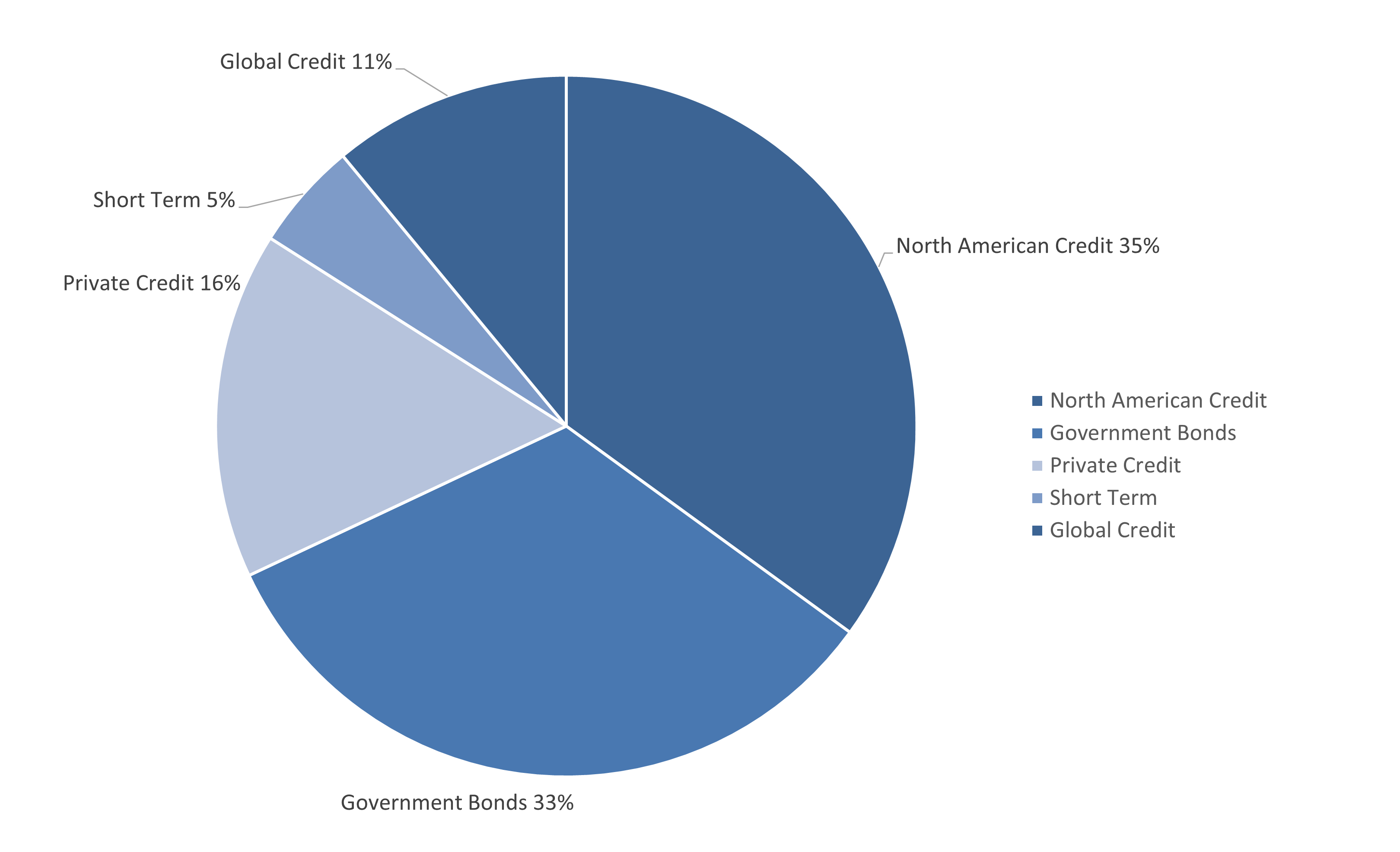

Fixed Income

Fixed income securities are investments that are typically issued by government entities or large corporations. They provide contractual payments at regular intervals as well as a repayment of the initial investment. Exposure to fixed income provides the Plan with stable cash flows to pay for member benefits and can reduce the Plan’s exposure to interest rate risk. We also manage a sleeve of private credit investments within the fixed income portfolio.

As demonstrated by the chart below, roughly 37% of our fixed income portfolio is invested in government securities with the other 63% invested in the debt of corporations.

Currently, public and private fixed income represents approximately 17% and 4% respectively of the Plan’s total assets.

Real Assets

The Plan’s real assets portfolio consists of our investments in real estate and infrastructure. Exposure to real assets help the Plan to hedge against inflation and diversify our portfolios while generating predictable income streams. Currently, we have 14% of total assets in real estate and 12% in infrastructure.

Public Market Alternatives

Public Market Alternatives consists of investments in fund structures that are absolute return oriented and aim to provide a steady return stream in excess of cash. These investments also have a lower correlation to the Plan’s other traditional asset classes. Currently, we have 3% of the Plan’s assets invested in public market alternatives.